Governments intervene in markets to try and overcome market failure. The government may also seek to improve the distribution of resources (greater equality). The aims of government intervention in markets include

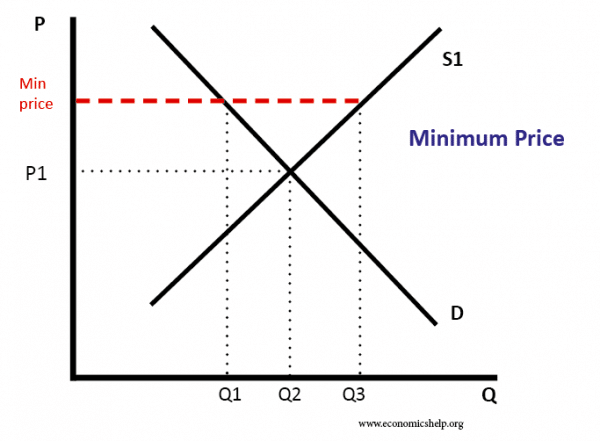

This involves the government setting a lower limit for prices, e.g. the price of potatoes could not fall below 13p.

The minimum price could be set for a few reasons:

A minimum price will lead to a surplus (Q3 – Q1). Therefore the government will need to buy the surplus and store it. Alternatively, it may impose quotas on farmers to decrease the quantity of the good put onto the market.

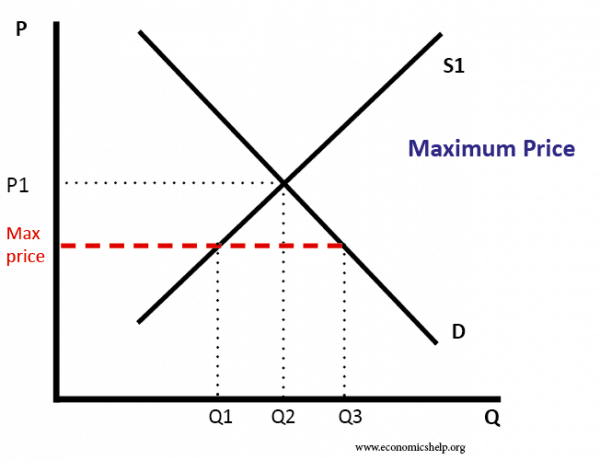

This involves putting a limit on any increase in price e.g. the price of housing rents cannot be higher than £300 per month.

Maximum prices may be appropriate in markets where

The Maximum price will be set below the equilibrium. This makes sure the price is less than the market clearing price.

Evaluation

If supply and demand are very inelastic, then a maximum price may have little adverse impact on creating shortages. For example, if supply housing for rent is very profitable, then a maximum price will not stop landlords putting the house on the market.

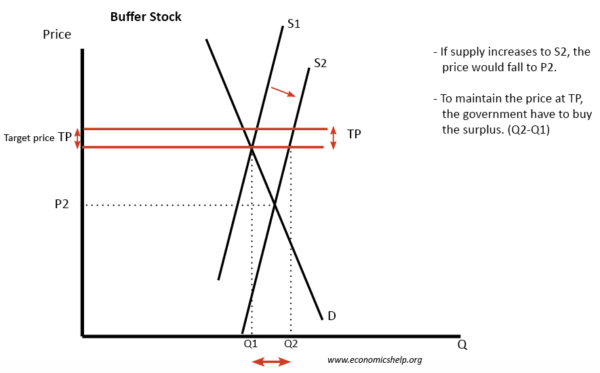

Agriculture suffers from various problems. These include:

Therefore the government may feel there is a case to intervene and stabilise prices. A buffer stock involve a combination of minimum and maximum prices. The idea is to keep prices within a target price band.

This is a different kind of government intervention. It is a government policy to influence demand indirectly. For example, putting cigarettes behind closed covers – makes it harder or less enticing for people to buy.

The government may also place flashing speed limit signs to give a smiley face to drivers under the speed limit, but an unhappy face to drivers exceeding the speed limit.

Tax is a method to discourage consumption of certain goods. For example, taxes on demerit goods – goods with negative externalities. Taxes both discourage consumption and raise revenue for the government.

In the above example, the tax moves output to Q2

Problems of tax

The government may subsidise goods with positive externalities (for example, public transport or education).

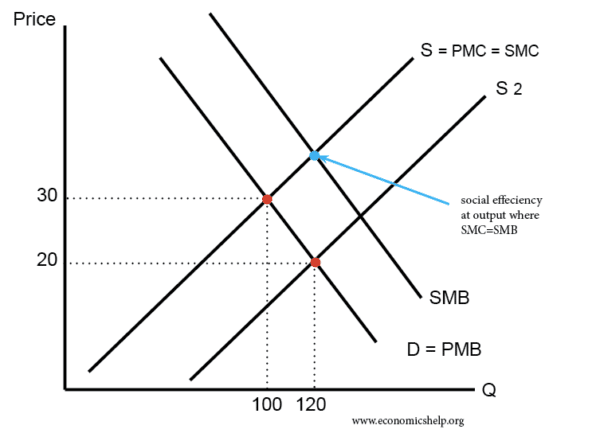

In the above example, a subsidy shifts output to 120 (where SMB = SMC) so it is more socially efficient.

Problems of subsidies